Are you ready for corporate tax?

The UAE's new accounting law necessitates digital workflows and record-keeping. Naqood is an accounting program that meets the law's requirements.

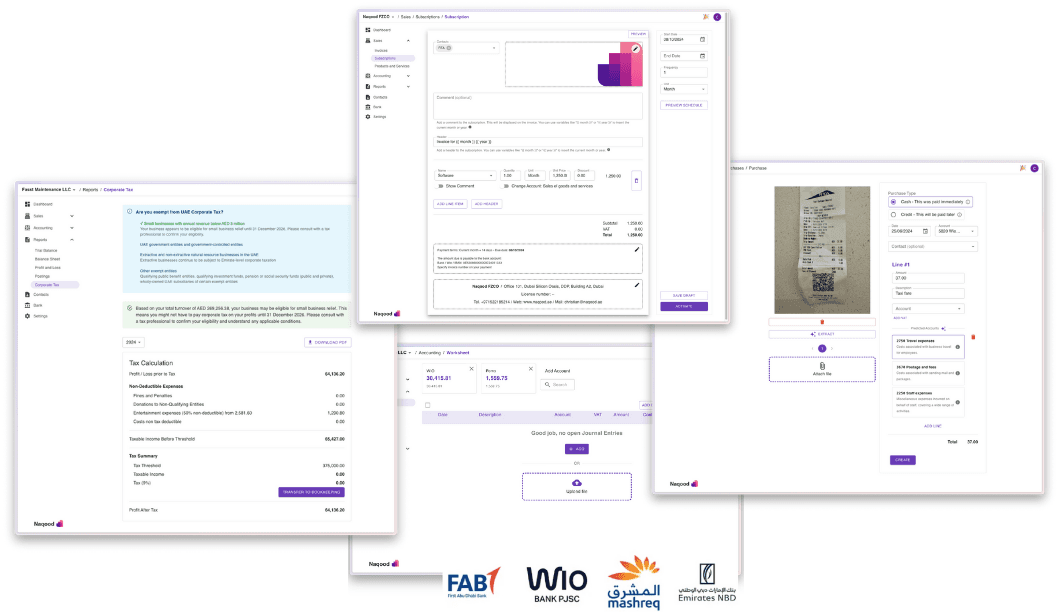

Businesses, including free zones and foreign entities, must follow corporate tax rules, irrespective of size or exemptions. Tax return filing is mandatory for compliance. Companies typically adhere to International Financial Reporting Standards (IFRS). All UAE firms, including those in free zones, must register for corporate tax, maintain records, and file tax returns to comply with tax regulations.

Multiple Users

Invite your employees and accountant

Empower your team with controlled access, maintaining oversight and authority. Find an accountant and invite them to your organization.

FTA Reporting

Submit FTA Compliant Financial Statement

free FTA-compliant financial statements, following IFAS accounting principles.

Send Invoices

Send unlimmeted eletronic invoices

Send electronic, FTA-compliant invoices for effortless financial management and compliance.

Get FTA compliant in minutes

Issue free invoices

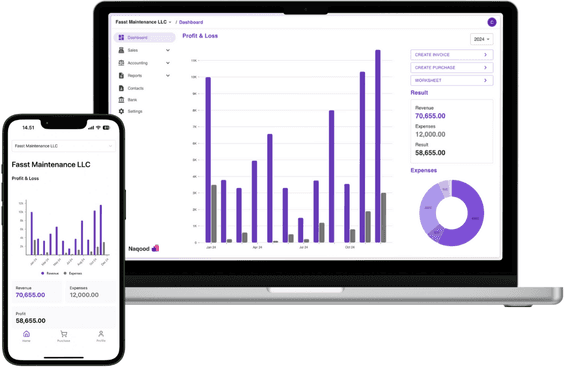

Keep a financial overview

Are you ready for Corporate Tax?

Get started with Naqood for free -

and be compliant with FTA in minutes.

Try your new, free, accounting tool

With Naqood you can issue invoices, record VAT transactions and much more in just a few clicks. Be FTA Corporate Tax compliant in minutes, no external accountant needed.

Adhere to the bookkeeping law by FTA n Naqood effortlessly, as we have integrated a lot of automatic bookkeeping assistance to ensure you get all your deductions.

Digital bookkeeping assistant to help you with accurate bookkeeping

Scan and upload your receipts quickly and easily

Avoid delving into complex accounting rules