Jan 25, 2025

Cash basis or accrual basis accounting

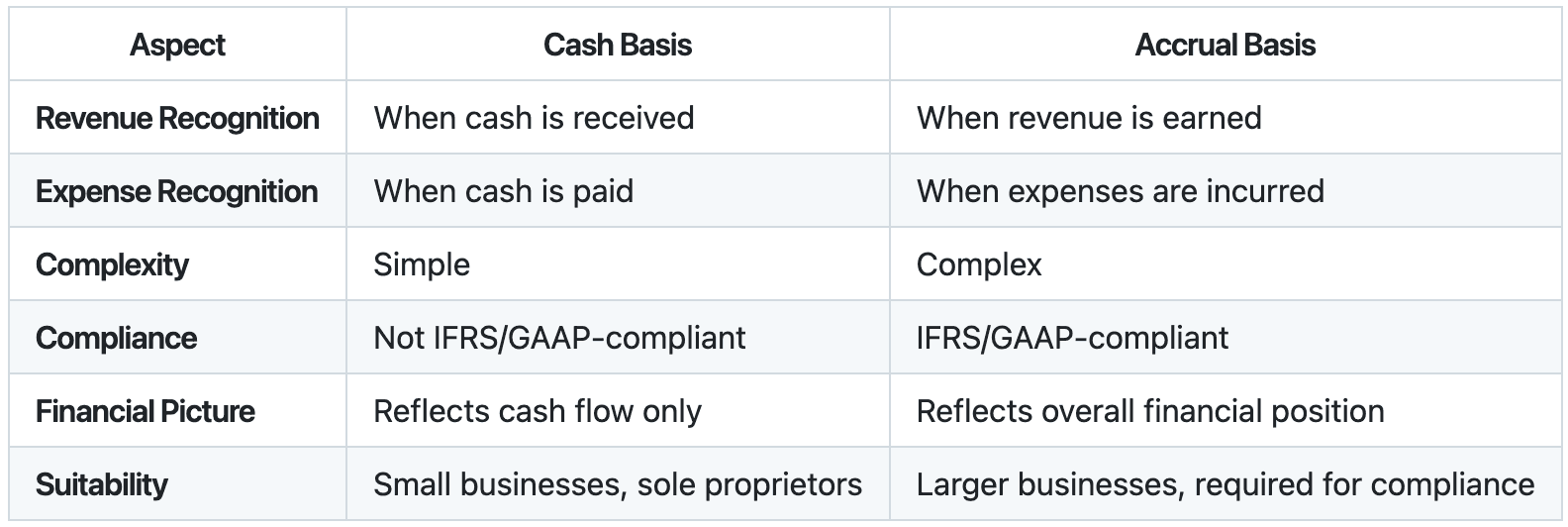

Cash basis and accrual basis are two primary methods of accounting used to record income and expenses in financial statements. They differ in terms of when transactions are recognized.

Key Differences Between Cash and Accrual Basis

Cash Basis Accounting

Definition

Under the cash basis of accounting, income and expenses are recorded only when cash is actually received or paid.

Key Characteristics

Revenue Recognition: Revenue is recorded when cash is received, regardless of when the sale occurred.

Expense Recognition: Expenses are recorded when cash is paid, regardless of when the expense was incurred.

Simplicity: This method is straightforward and easy to use, making it popular for small businesses or individuals.

Advantages

Easy to understand and implement.

Reflects actual cash flow, making it simple to see how much cash is available at any time.

Avoids complex accounting adjustments.

Disadvantages

Does not provide a complete picture of financial health since it ignores receivables and payables.

Not compliant with International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP) for most businesses.

Accrual Basis Accounting

Definition

Under the accrual basis of accounting, income and expenses are recorded when they are earned or incurred, regardless of when cash is received or paid.

Key Characteristics

Revenue Recognition: Revenue is recognized when it is earned (e.g., when goods are delivered or services are performed), even if cash has not yet been received.

Expense Recognition: Expenses are recorded when they are incurred (e.g., when goods or services are received), even if payment has not been made.

Complexity: This method requires adjustments for accounts receivable, accounts payable, and deferred revenue.

Advantages

Provides a more accurate and complete picture of a business's financial health.

Complies with IFRS and GAAP, making it suitable for larger businesses and financial reporting.

Facilitates better matching of income and expenses in the correct periods (matching principle).

Disadvantages

More complex and time-consuming than the cash basis.

Does not reflect actual cash flow, which can lead to challenges in cash management.

Which Should You Use?

Cash Basis: Suitable for small businesses or individuals who want to keep accounting simple and are not required to report under IFRS or GAAP.

Accrual Basis: Necessary for larger businesses, those with complex operations, or when financial reporting standards require it. It is also more useful for analyzing long-term business performance.

Most business that uses Naqood will be using Accrual Basis.

If you’re unsure which method to use, consulting an accountant or financial advisor can help align your accounting approach with your business needs and legal requirements. See our list of FTA approved accountants in UAE agents here.

About the author

Christian Falck, a 2018 Copenhagen Business School graduate with a Master's in Finance and Accounting, also excelled at Columbia University in Corporate Finance. With 11+ years in accounting, his accounting firm won 3x Børsen Gazelle awards consecutively. Since 2021, he has been based in Dubai.