Jan 25, 2025

Small Business Relief in the UAE

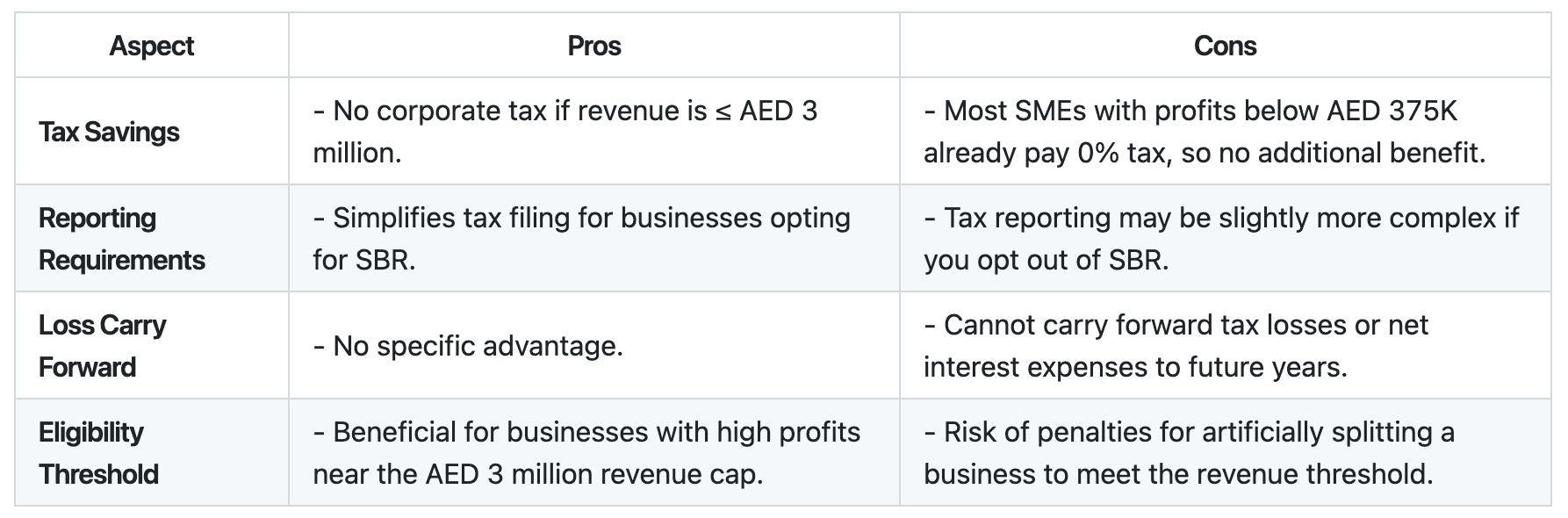

The Small Business Relief (SBR) initiative allows businesses with annual revenues of AED 3 million or less to be exempt from corporate tax. However, this decision has both advantages and downsides.

Pros of Applying for SBR

Tax Savings

No corporate tax liability if revenue is ≤ AED 3 million.

Ideal for businesses with high profits near the revenue threshold.

Simplified Compliance

Reduces tax filing obligations for businesses that qualify.

Cons of Applying for SBR

Tax Loss Carryover Restrictions

You cannot carry forward tax losses or net interest expenditure to future years.

This is a major drawback for businesses planning to reinvest or grow.

Minimal Benefit for Low-Profit SMEs

Most SMEs with profits under AED 375K already pay 0% corporate tax under standard rules.

Opting for SBR offers no additional advantage in these cases.

Slightly More Complicated Tax Reporting if Opted Out

Businesses not electing for SBR may have slightly more complex compliance requirements.

Who Should Apply for SBR?

Good Fit: High-profit businesses nearing AED 3 million in revenue.

Not Recommended: SMEs with profits below AED 375K, as SBR adds no tax savings and blocks the ability to carry forward losses.

Final Recommendation

Carefully evaluate your business's profitability and growth plans. If you expect to reinvest profits or anticipate losses, opt out of SBR to maintain flexibility for future tax benefits.

If you’re uncertain about whether to apply for Small Business Relief, consulting a qualified accountant or financial advisor can provide valuable guidance to ensure your accounting approach aligns with your business objectives and complies with legal requirements. See our list of FTA approved accountants in UAE here.

About the author

Christian Falck, a 2018 Copenhagen Business School graduate with a Master's in Finance and Accounting, also excelled at Columbia University in Corporate Finance. With 11+ years in accounting, his accounting firm won 3x Børsen Gazelle awards consecutively. Since 2021, he has been based in Dubai.