Feb 17, 2026

Bank Reconciliation Guide for UAE Businesses | Naqood Tutorial

This guide will help UAE business owners and accountants efficiently use Naqood's Bank Reconciliation module to manage and reconcile bank transactions.

Getting Started

Set Up Your Bank Accounts

Before importing transactions, ensure your bank accounts are properly configured:

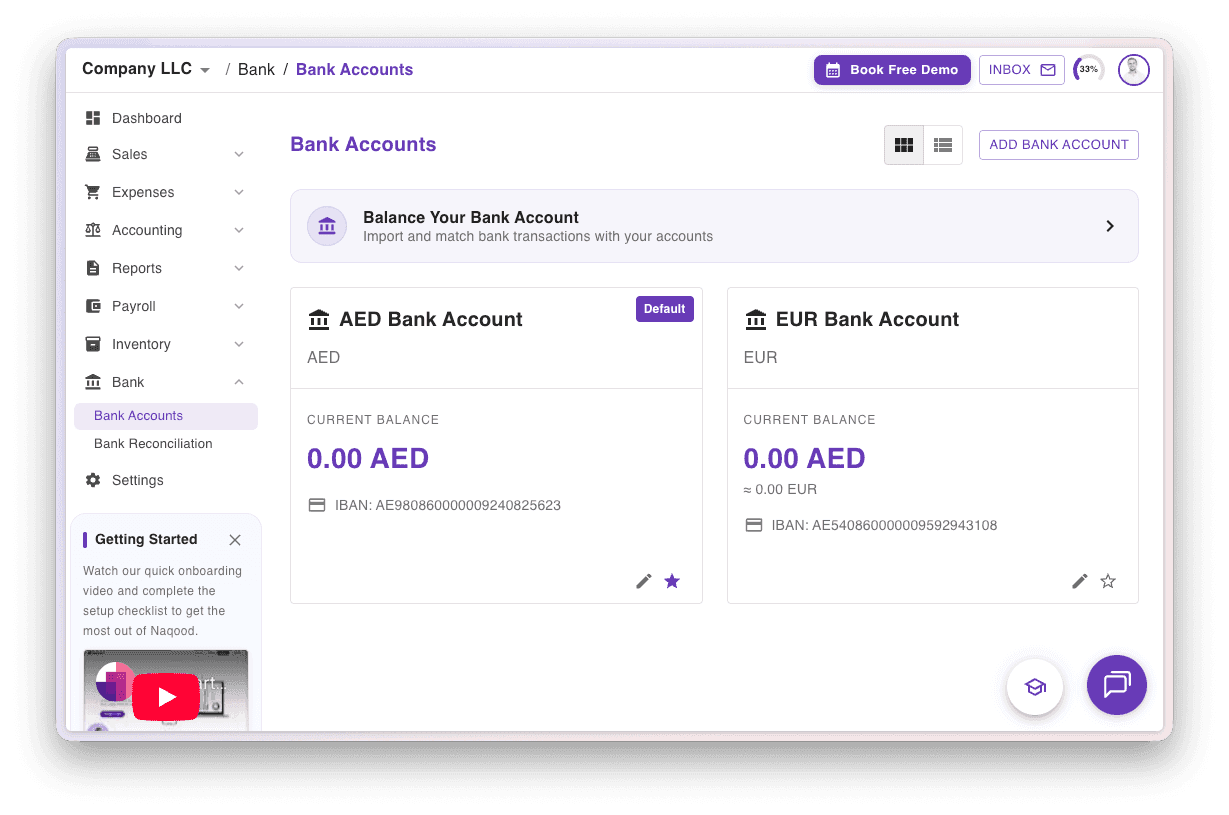

Navigate to Bank → Bank Accounts

Add your bank's IBAN number for each account

⚠️ Important:The IBAN is used to match imported bank transactions to the correct account

Importing Bank Transactions

You can import transactions using two methods:

Method 1: CSV Import

Upload bank statements in CSV format by dragging and dropping the file.

Supported Banks:

First Abu Dhabi Bank (FAB)

Emirates NBD (ENBD)

Mashreq

Wio

For other banks:

Use our CSV template for manual imports

Contact our in-app support team to request adding your bank (if the statement format is compatible)

Import Steps:

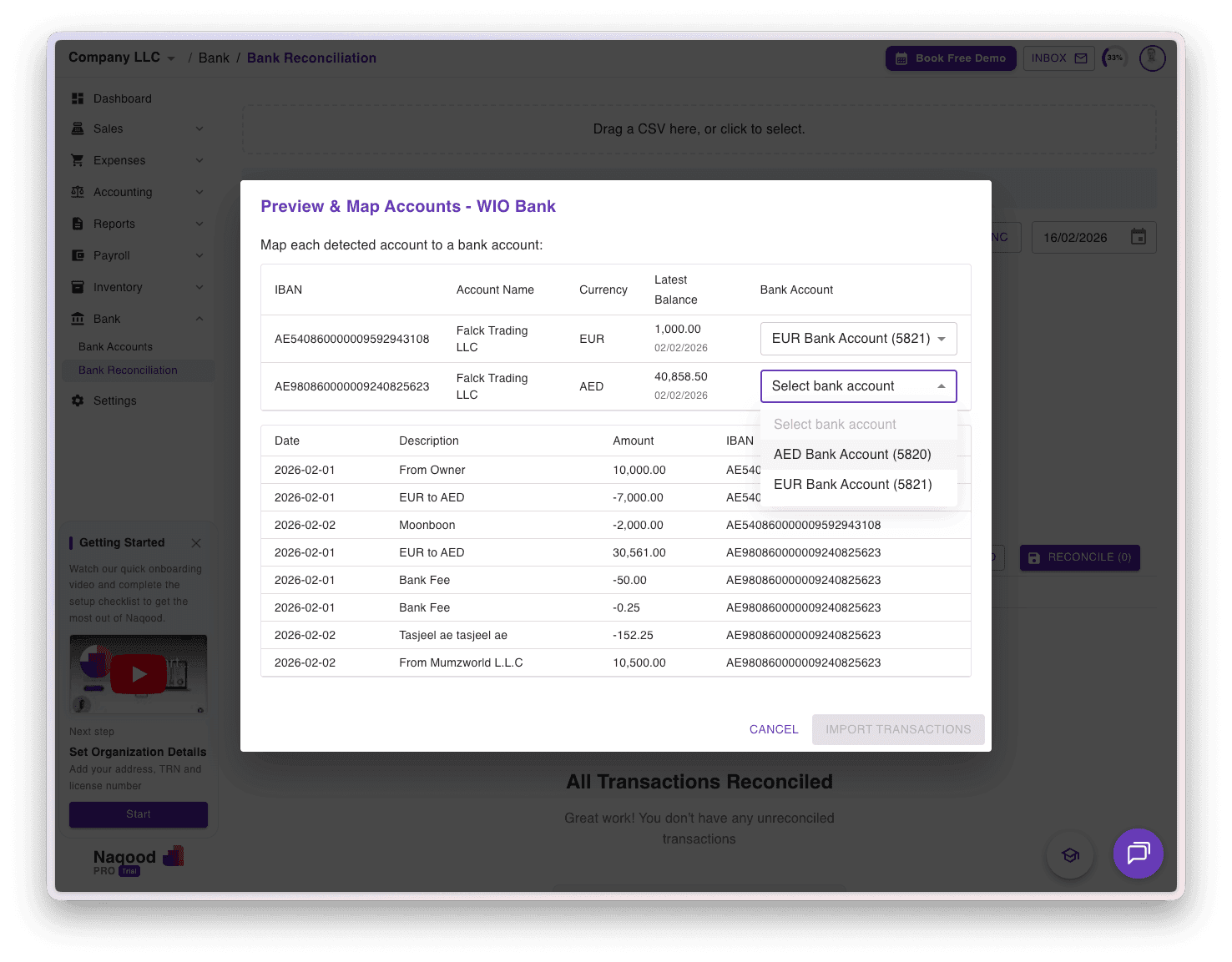

Upload your CSV file

Match the bank accounts from the statement to your Naqood accounts (based on currency)

Click "Import Transactions"

⚠️ Important: Ensure reference numbers are truly unique. Duplicate reference numbers will cause transactions to be skipped to prevent data duplication.

Method 2: Bank Sync (Direct Integration)

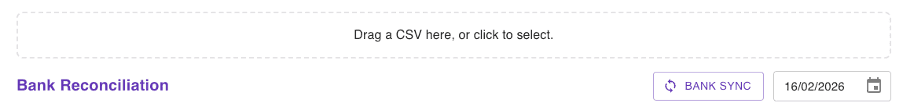

Click "Bank Sync" to automatically fetch transactions directly from your bank.

Currently Supported:

Wio

Mashreq

Reconciling Transactions

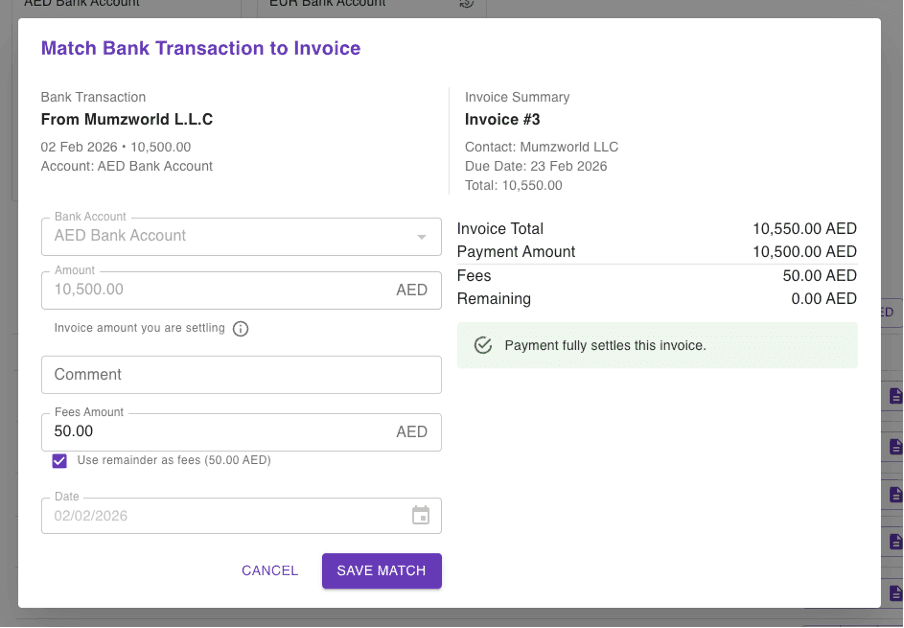

Match to Invoice Payment

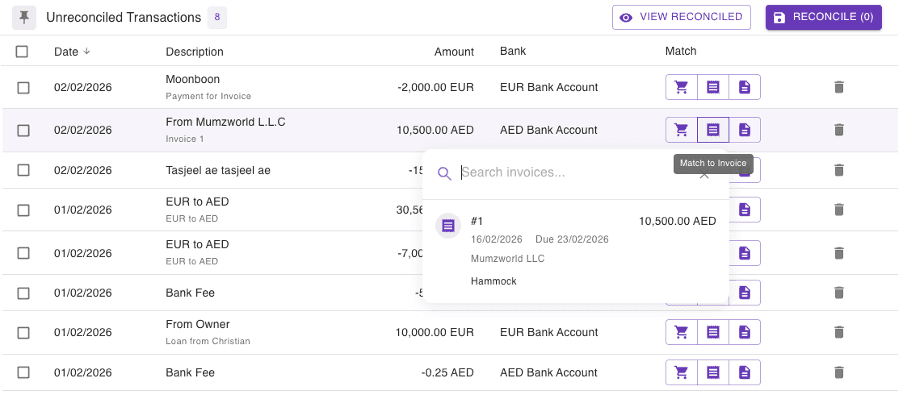

When you've received payment for an invoice:

Click "Match to Invoice"

Search and select the corresponding invoice

Same Currency: The full amount automatically settles the invoice

Partial Payment: Check "remainder is fee" to book the difference as bank fees

Match to Purchase Payment

When you've made a payment for a purchase:

Click "Match to Purchase"

Search and select the corresponding purchase

Same Currency: The full amount automatically settles the purchase

Overpayment: Enter a "fee amount" to book the difference as bank fees

💡 Tip: Naqood automatically calculates exchange rate gains/losses on foreign transactions per FTA requirements. This means an AED value will be calculated for your foreign holdings. Use the "Currency Conversion" template at year-end to adjust any balances.

Create a New Purchase

You can create a purchase directly from the reconciliation screen:

Click "Match to Purchase"

Select "Create New Purchase"

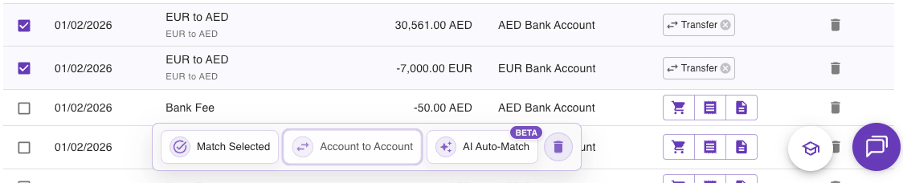

Account-to-Account Transfers

For internal transfers between your bank accounts (e.g., EUR 7,000 from EUR account → AED 30,561 to AED account):

Select both transactions using the bulk selector (one outgoing, one incoming)

Click "Account to Account Transfer"

Add any bank fees if applicable

✓ Naqood automatically calculates and books exchange rate variances.

⚠️ Note: You can only select 2 transactions at a time (one debit, one credit).

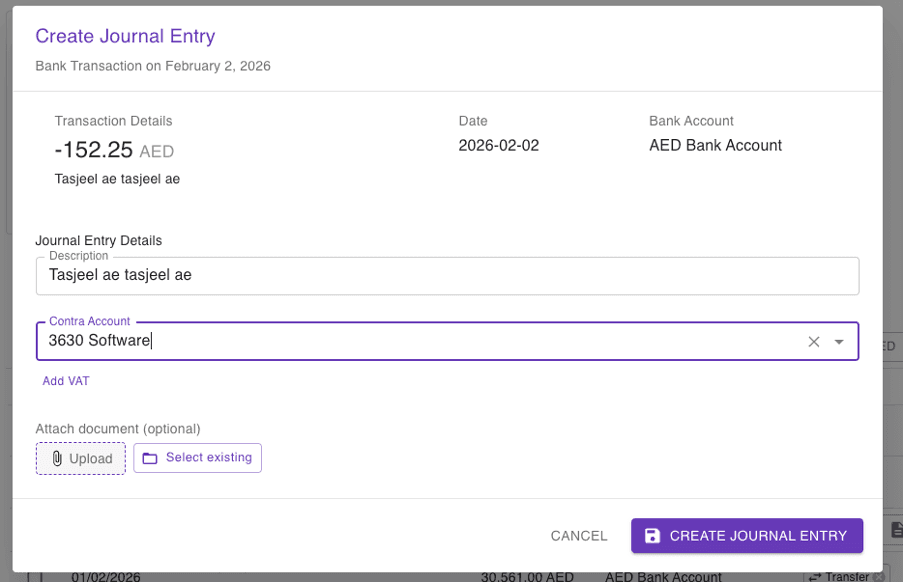

Create Journal Entries

For Single Transactions:

Click "Create Journal Entry"

Select the appropriate account from the chart of accounts

Example: Software expenses → "3630 Software"

Example: Owner contributions → "6850 Debt to Owner"

(Optional) Upload supporting documentation

View the full chart of accounts under Settings → Accounts

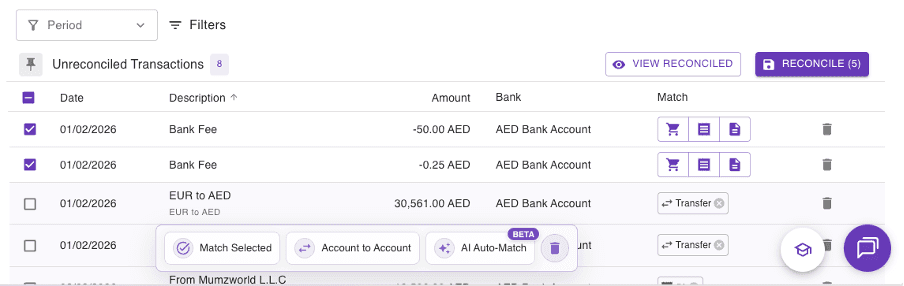

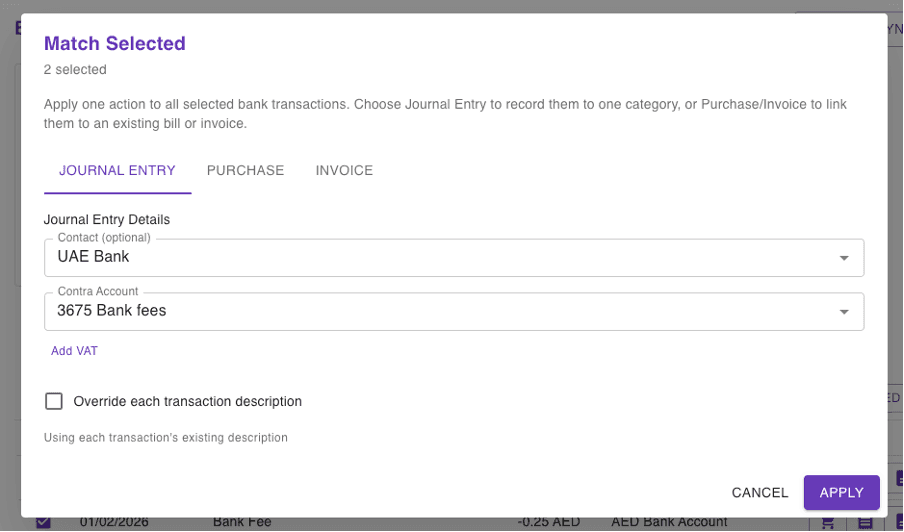

Bulk Journal Entries

Ideal for processing multiple similar transactions without individual purchase records.

Steps:

Filter transactions by:

Period

Currency

Text field (e.g., "bank fee")

Sort by date or description

Select the transactions you want to process

Click "Match Selected"

Choose the destination account

Common Bulk Entry Accounts:

3675 – Bank Fees

2720 – Advertising and Promotion

Need Help?

Contact our in-app support team for:

Adding unsupported banks

Technical assistance

Account setup questions

About the author

Christian Falck, a 2018 Copenhagen Business School graduate with a Master's in Finance and Accounting, also excelled at Columbia University in Corporate Finance. With 11+ years in accounting, his accounting firm won 3x Børsen Gazelle awards consecutively. Since 2021, he has been based in Dubai.