Feb 18, 2026

How to File Corporate Tax in UAE with Small Business Relief – Step-by-Step Guide (2026)

Filing your corporate tax doesn't have to be complicated. If you have your numbers ready, it takes less than an hour. Here's exactly what to do.

Before you log in – have these 2 things ready

Make sure your books are up to date in Naqood

Your total revenue (turnover) for the tax period – find it in your Profit & Loss report

What will I actually pay?

The UAE tax rate is simple: 0% on the first AED 375,000 of taxable income, and 9% on anything above that. If your total revenue is under AED 3 million, you may qualify for Small Business Relief and pay nothing at all – you can apply directly when filing.

Phase 1 – Log in and find your return (Steps 1–3)

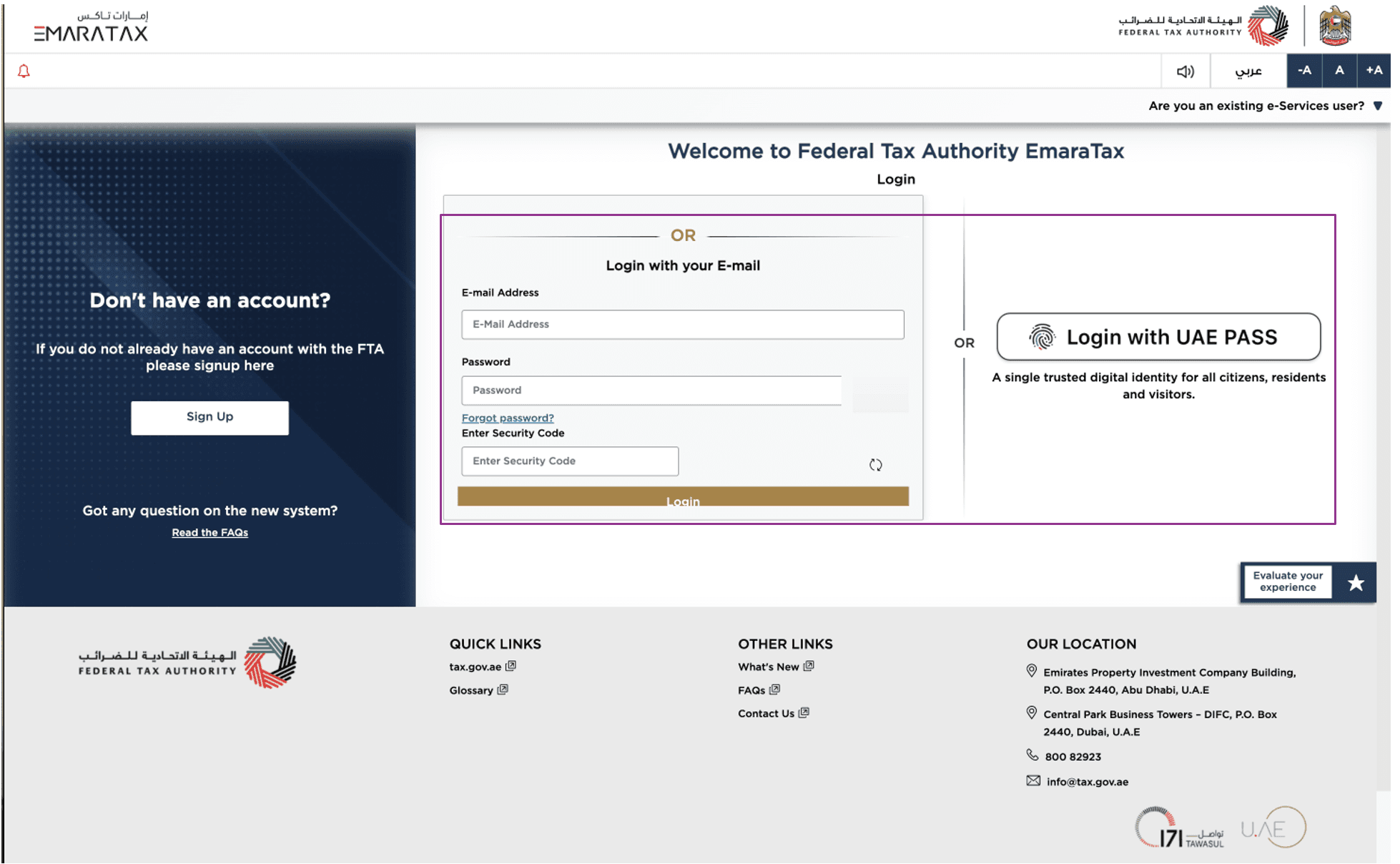

Step 1 - Login to EmaraTax

First go to EmaraTax.

Login with UAE PASS or e-mail credentials.

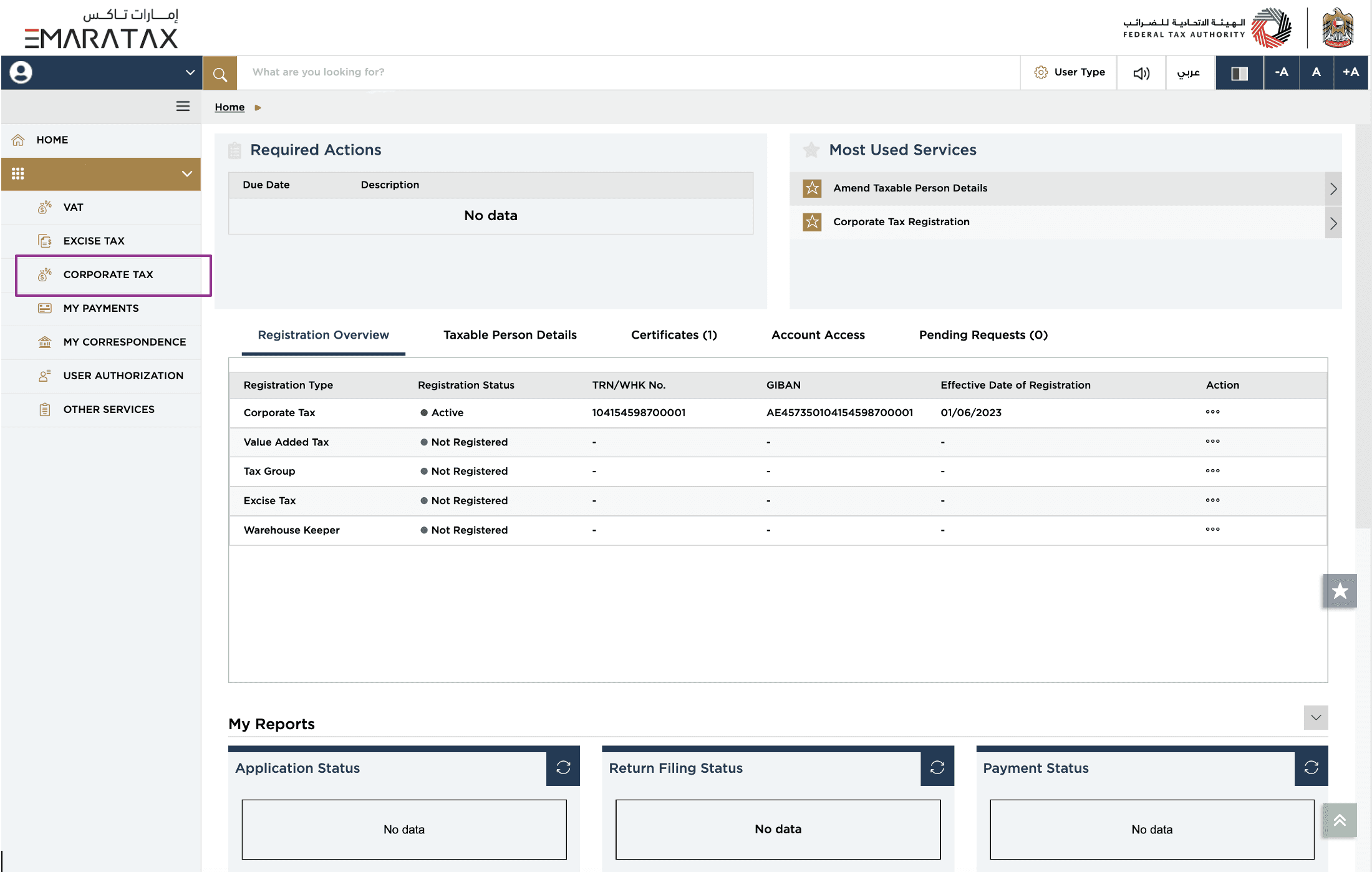

Step 2 - Select Corporate Tax menu”

Click on the left menu bar that states “Corporate Tax”

Press "veiw all"

If the action does not appear, it means your corporate tax period has not yet ended or that the FTA hasn't open for your filing. You will need to wait until it closes before you can file.

To check your tax period, refer to your Corporate Tax Registration.

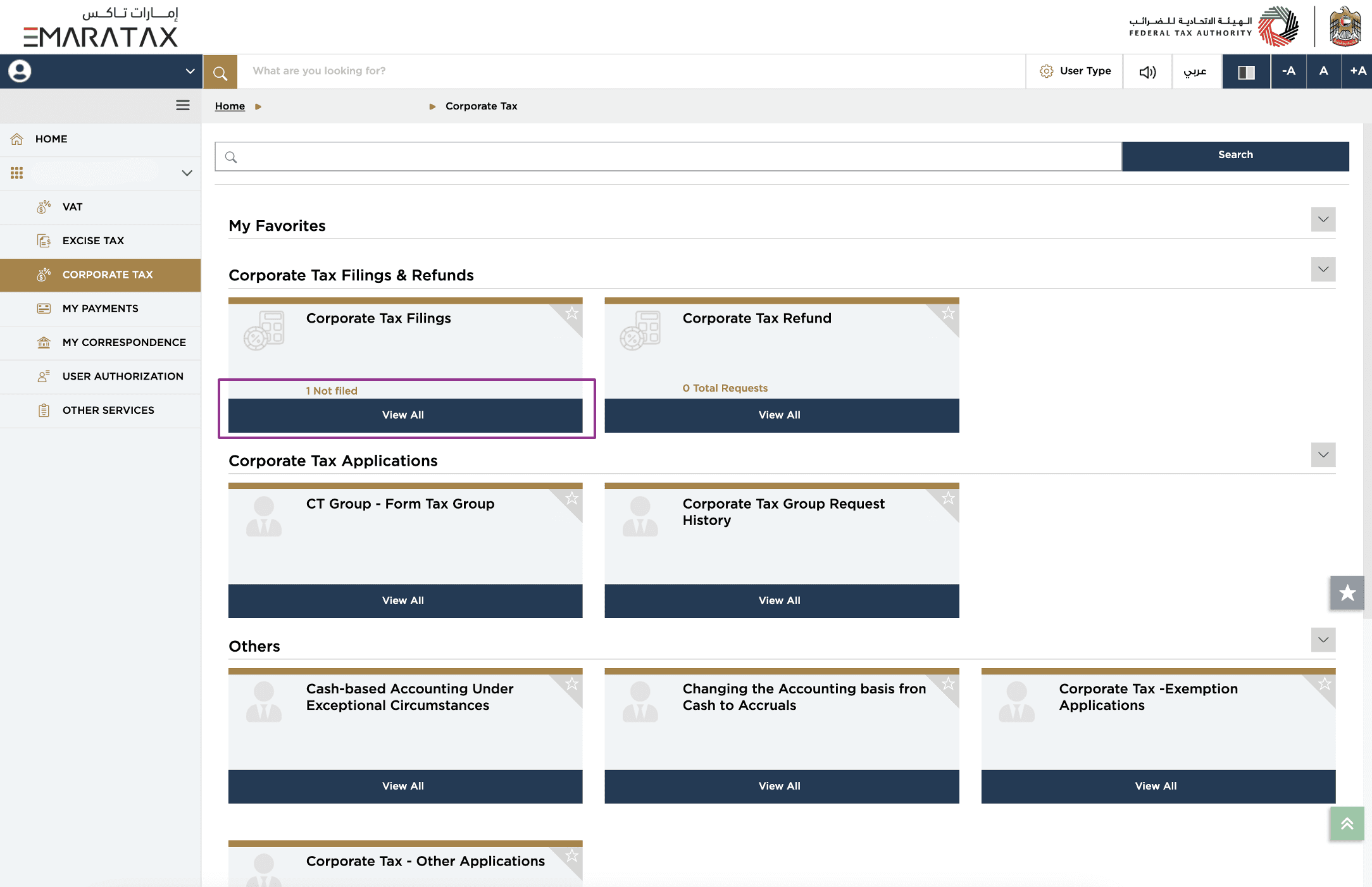

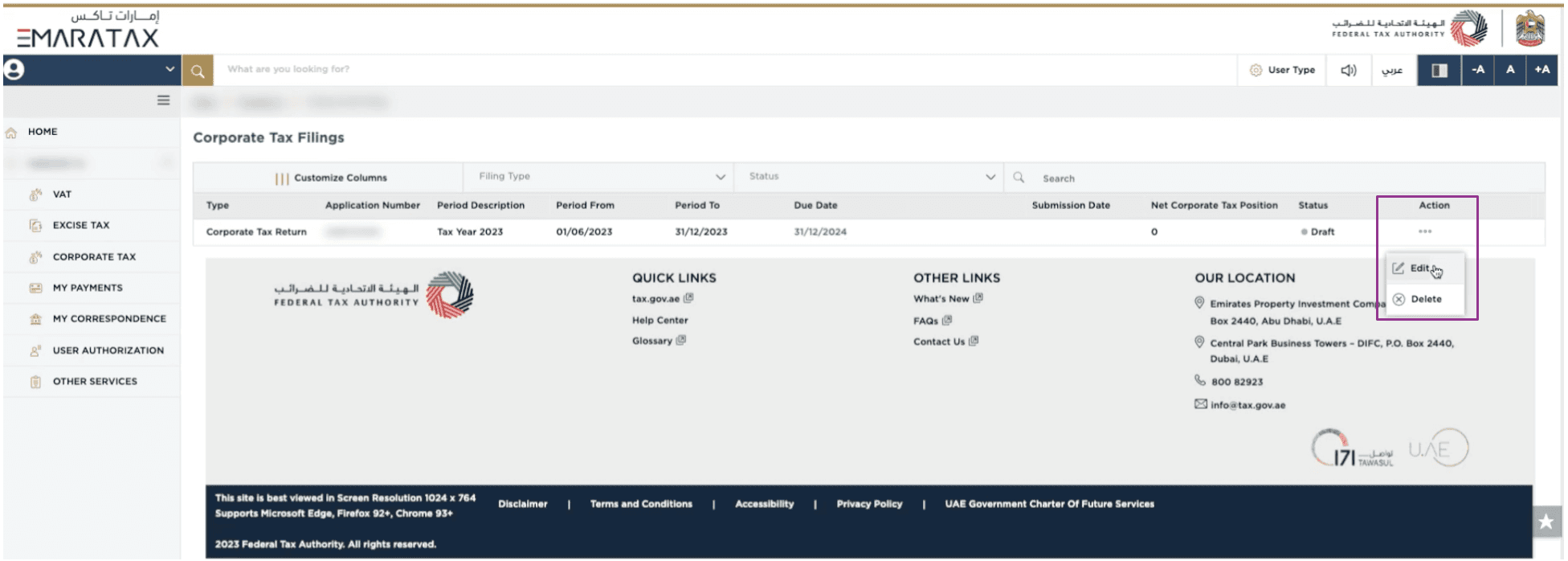

Step 3 - Corporate Tax filing

Click on the … under the Action column and select “Edit”

Phase 2 – Fill in your details (Steps 4–7)

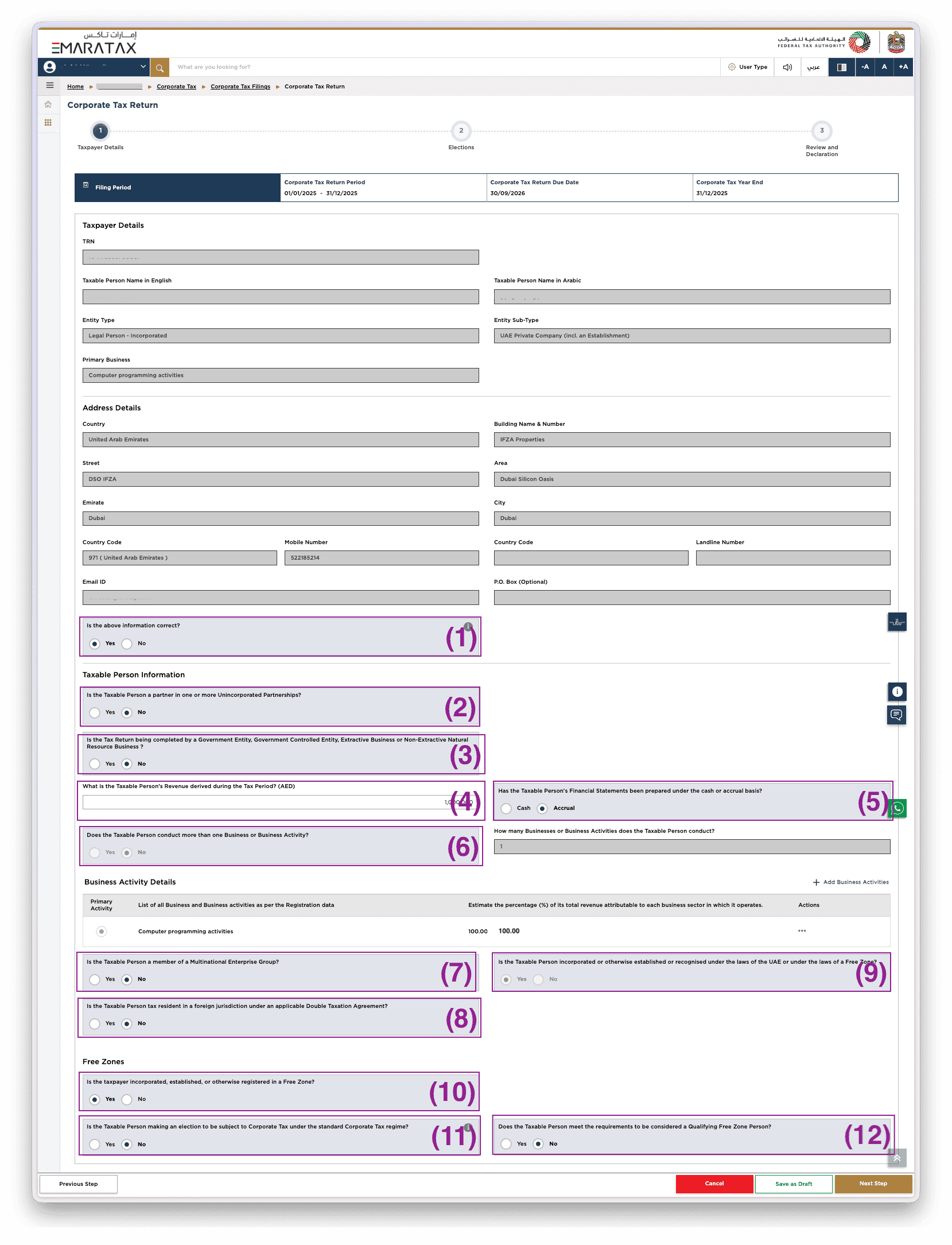

Step 4 - Taxpayer details

Check if your details are correct.

TRN, Name, Address, Email, Phone

(1) Is the above information correct?

Press Yes – if they are correct

Press No – if they are incorrect and need to be amended.

Step 5 - Taxable Person Information

(2) Is the Taxable person a partner in one or more Uncorporated Partnerships

Press Yes – If you are a business, individuals with specific business-related income, or partnerships meeting certain criteria. (Most businesses)

Press No – If Joint ventures without a formal legal structure or Partnerships under mutual agreement but not registered as a legal entity.

(3) Is the Tax Return being completed by a Government Entity, Government Controlled Entity, Extractive Business or Non-Extractive Natural Resource Business ?

Press Yes – If the Tax Return is being completed by a Government Entity, Government Controlled Entity, Extractive Business or Non-Extractive Natural Resource Business

Press No – If the Tax Return is not being completed by a Government Entity, Government Controlled Entity, Extractive Business or Non-Extractive Natural Resource Business. (Most Naqood businesses)

(4) What is the Taxable Person’s Revenue derived during the Tax Periode (AED)

Insert the total Turnover for the tax period.

In Naqood can you find this in 3 reports:

Trail Balance

Profit and Loss

Corporate Tax

(5) Has the Taxable Person’s Financial Statements been prepared under the cash or accrual basis?

Press Cash – if revenue and expenses are recognized when received

Press Accrual – if revenue and expenses are recognized when earned

If you are in doubt of which to choose, you can read our guide here.

Step 6 - Business Activity Details

(6) Does the Taxable Person conduct more than one Business or Business Activity?

Press Yes – if you have more than one Business or Business Activity

Press No – if you do not have more than one Business or Business Activity

Click Actions -> Edit

Fill in the Estimate the percentage (%) of its total revenue attributable to each business sector in which it operates.

(7) Is the Taxable Person a member of a Multinational Enterprise Group

Press Yes – if you are a member of a Multinational Enterprise Group.

Press No – if you are not a member of a Multinational Enterprise Group.

(8) Is the Taxable Person tax resident in a foreign jurisdiction under an applicable Double Taxation Agreement?

You would know this if you had applied for it and were recognized as a tax resident in a foreign jurisdiction.

Typically would it be:

Press Yes – if you are a branch of a different company.

Press No – if you are not a branch.

Please consult with a FTA approved accountants in UAE agent if you are in doubt.

Step 7 - Free Zones

(9) Is the Taxable Person incorporated or otherwise established or recognized under the laws of the UAE or under the laws of a Free Zone?

This is based on your company details and cannot be changed unless you amend your Tax payer details.

(10) Is the taxpayer incorporated, established, or otherwise registered in a Free Zone?

This is already pre-filled based on your previous details.

(11) Is the Taxable Person making an election to be subject to Corporate Tax under the standard Corporate Tax regime?

Press Yes - if the company wants to be subject to the standard Corporate Tax regime.

Press No - if the company does not want to be taxed under the standard regime (for example, if it may be eligible for Small Business Relief or another special tax regime, such as Qualifying Free Zone Persons)

(12) Does the Taxable Person meet the requirements to be considered a Qualifying Free Zone Person?

Press Yes – if you are not part of a Qualifying Free Zone.

Press No – if you are part of a Qualifying Free Zone, see the list here.

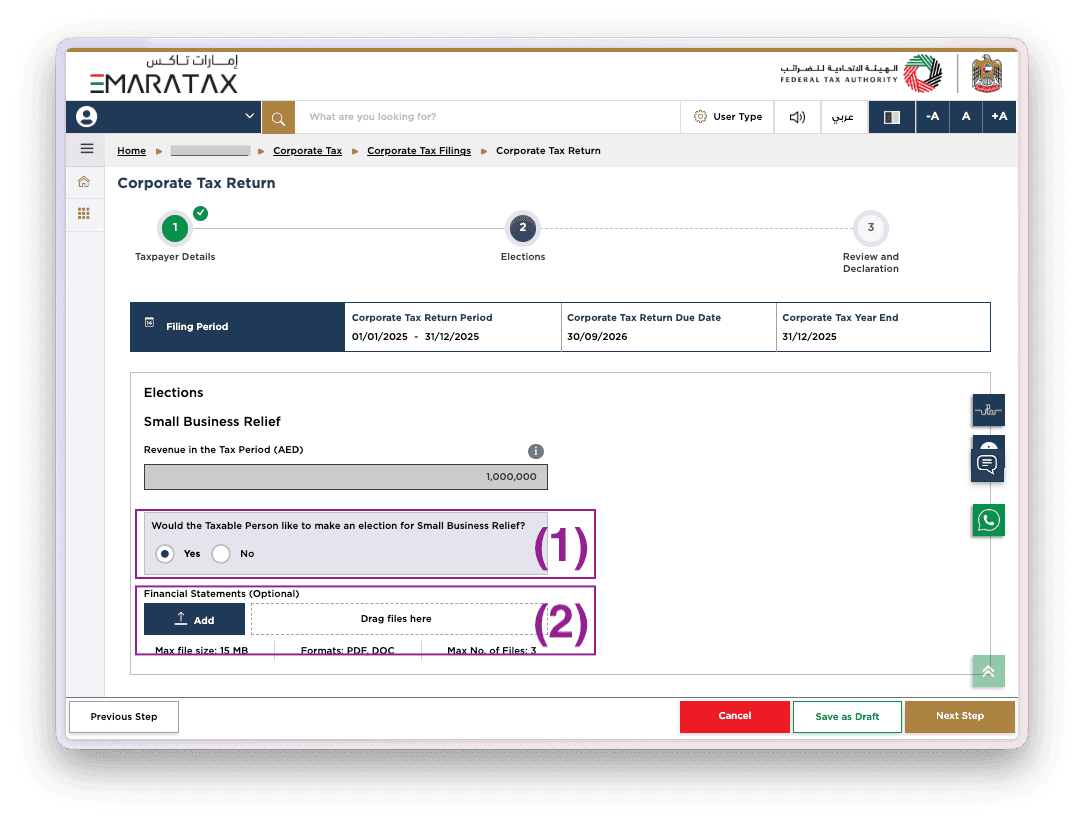

Phase 3 – Elections, Small Business Relief

Step 8 -Elections

Revenue in the Tax Period (AED), this is filled in the previous step.

(1) Would the Taxable Person like to make an election for Small Business Relief?

Press Yes – if you want to apply for it.

Press No – if you don’t want to apply for it.

Read more about Small Business Relief here

(2) Financial Statements (Optional)

This is optional, but can be downloaded from Naqood.

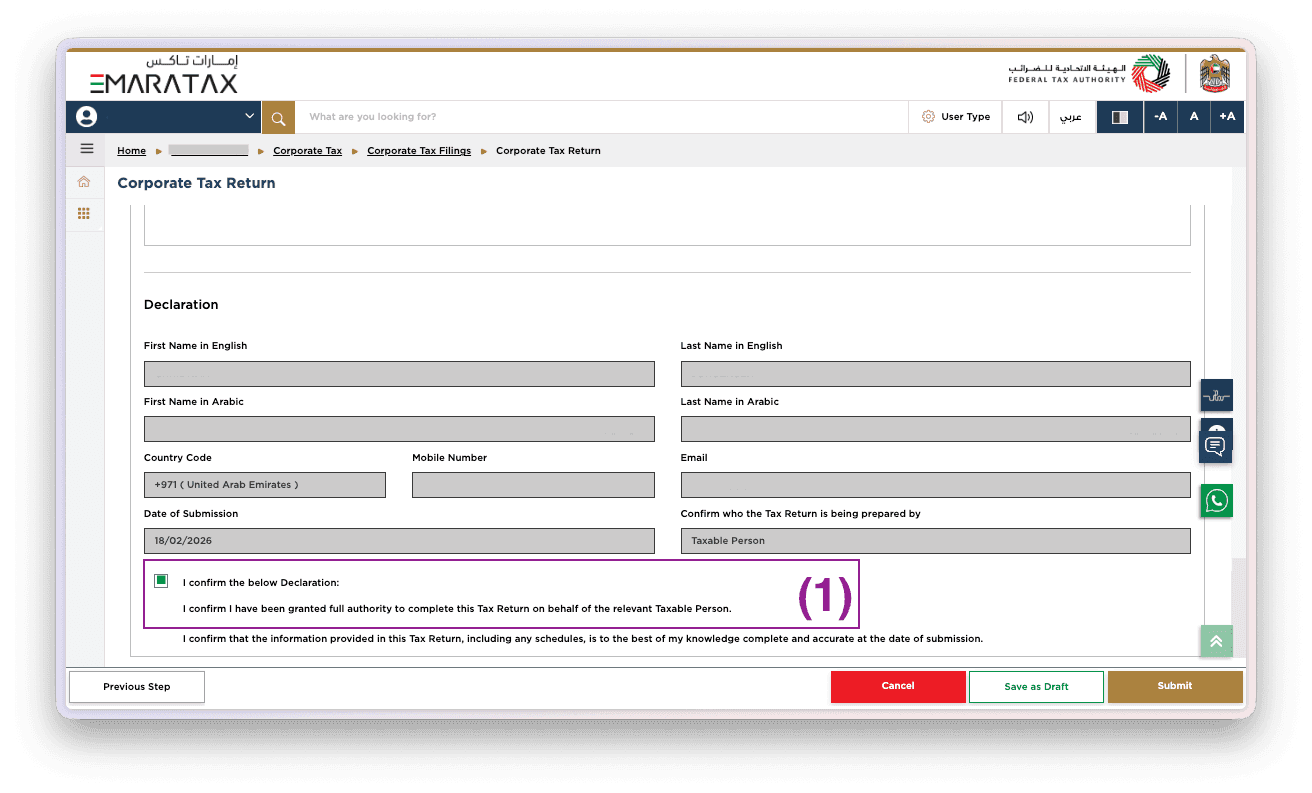

Phase 4 – Review and Declaration

Step 9 -Submit

(1) Click the checkmark that the information provided is the best of your knowledge

Congratulations you have now filed your first corporate tax return.

Frequently Asked Questions (FAQ) – Filing Corporate Tax in UAE

1. Who needs to file corporate tax in the UAE?

Corporate tax in the UAE applies to all businesses and individuals conducting business activities in the country, except for those eligible for exemptions.

2. What is the corporate tax rate in the UAE?

The UAE corporate tax rate is:

0% for taxable income up to AED 375,000

9% for taxable income exceeding AED 375,000

A different rate for multinational companies with global revenues exceeding EUR 750 million, subject to OECD Pillar Two rules.

3. What is the deadline for filing corporate tax in the UAE?

The deadline depends on your financial year-end:

Your tax return must be filed within 9 months from the end of your financial year.

For example, if your financial year ends on December 31, your corporate tax filing deadline will be September 30 of the following year.

4. How do I file corporate tax in the UAE?

To file your corporate tax return:

Log in to EmaraTax using UAE PASS or email credentials.

Go to “Required Actions” and select Corporate Tax – Return Submission.

Fill in the required details, including taxable revenue, expenses, and financial statements.

Review and submit your corporate tax return.

For a detailed step-by-step guide, follow our full corporate tax filing guide here.

5. What documents are required for corporate tax filing in UAE?

You will need:

Trade License

Corporate Tax Registration Number (TRN)

Financial Statements (Profit & Loss, Balance Sheet, Tax Calculation Report)

6. What happens if I miss the corporate tax filing deadline?

If you fail to file your corporate tax return on time, the Federal Tax Authority (FTA) may impose penalties, including:

Late filing penalty

Late payment fines

Additional compliance violations

To avoid penalties, make sure to submit your corporate tax return before the deadline.

7. Can Free Zone companies file for 0% corporate tax?

Yes, if your Free Zone business qualifies as a "Qualifying Free Zone Person (QFZP)," you may be eligible for the 0% corporate tax rate.

To qualify, you must:

Generate qualifying income as per FTA guidelines

Meet economic substance requirements

Not conduct business with mainland UAE

For details, read our guide on Qualifying Free Zones in UAE for Corporate Tax.

8. What is Small Business Relief, and how do I apply for it?

If your business generates revenue below AED 3 million, you may qualify for Small Business Relief, which allows you to avoid paying corporate tax.

To apply:

Indicate "Yes" for Small Business Relief when filing your tax return.

Submit supporting documentation if required by the FTA.

Read more about Small Business Relief in the UAE.

9. Can I amend a corporate tax return after submission?

Yes, if you made an error in your tax filing, you can file an amendment request through EmaraTax. However, amendments may be subject to penalties if errors result in underpayment.

10. How can I get help with corporate tax filing in UAE?

If you need expert assistance, you can consult FTA-approved accountants to ensure compliance and optimize tax savings.

Find an FTA-approved tax advisor here.

Focus on growing your business while Naqood handles the taxes for you. Try it today!

About the author

Christian Falck, a 2018 Copenhagen Business School graduate with a Master's in Finance and Accounting, also excelled at Columbia University in Corporate Finance. With 11+ years in accounting, his accounting firm won 3x Børsen Gazelle awards consecutively. Since 2021, he has been based in Dubai.